Many businesses like yours are exploring the benefits of outsourcing accounting and bookkeeping as a strategy to reduce staff costs. By transferring these responsibilities to external experts, you can not only cut down on payroll expenses but also gain access to specialized knowledge and technology without the overhead of hiring full-time employees. However, it’s important to weigh the potentially hidden costs and challenges against the expected savings, ensuring you make an informed choice that benefits your company’s bottom line.

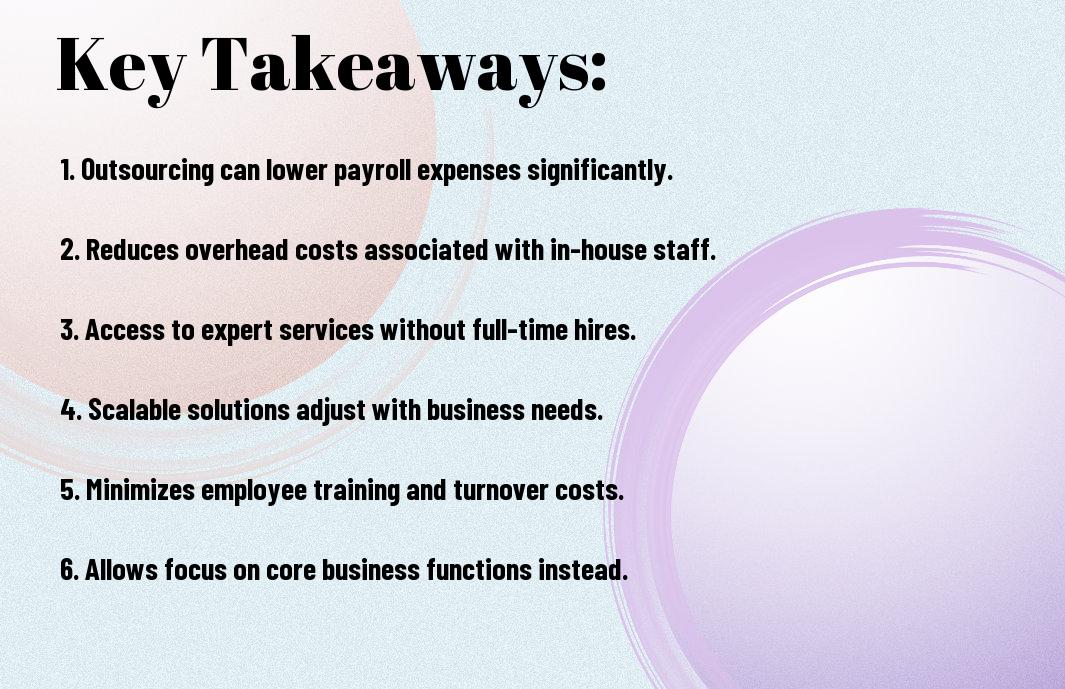

Key Takeaways:

- Outsourcing accounting and bookkeeping can significantly lower overhead expenses by eliminating the need for in-house staff and associated costs like benefits and office space.

- Access to specialized skills and technologies through outsourcing can enhance efficiency and accuracy, potentially leading to cost savings that exceed initial outsourcing expenses.

- Flexibility in scaling services is an advantage of outsourcing, allowing businesses to adjust their accounting needs without the complexities of hiring or laying off staff.

Understanding Accounting Outsourcing

A key component of modern business strategy, outsourcing has emerged as a viable solution for managing various operational facets, including accounting and bookkeeping. It refers to the practice of delegating specific tasks or functions to third-party service providers, allowing your company to focus on its core operations. This can mean hiring an external firm to handle your financial transactions, payroll processing, tax preparation, or overall financial reporting. The scope of outsourced accounting can range from basic bookkeeping services to comprehensive financial management, resulting in substantial cost savings and enhanced efficiency.

Definition and Scope of Outsourced Accounting

Outsourcing in accounting not only leads to decreased operational burdens but also opens the door to specialized expertise. When you opt for outsourced accounting services, you are tapping into skilled professionals who are up-to-date with the latest regulatory standards and technological advancements. They take charge of tasks that might otherwise require significant in-house investment, allowing your company to allocate resources more effectively. Ultimately, this can lead to better financial data accuracy and faster reporting, which are important for informed decision-making.

Modern Trends in Financial Operations

Accounting trends have evolved significantly over the years, with businesses increasingly relying on technology and automation. Cloud-based accounting solutions, for example, have gained popularity, allowing you to access your financial data in real time from anywhere. These technologies can dramatically improve efficiency and transparency, while minimizing the chances of human error. In addition, there’s a growing emphasis on using data analytics within financial operations, enabling firms to gain insights from their financial health and make educated predictions for future growth.

For instance, many organizations are embracing artificial intelligence (AI)

It is imperative to conduct a thorough cost analysis when considering whether to manage your accounting functions in-house or to outsource them. Outsourcing can provide a clear financial advantage by significantly reducing direct salary and benefit expenses. You might be surprised to find that the cost of hiring and maintaining an in-house accounting team often extends beyond just their salaries. Additional expenses such as benefits, payroll taxes, and ongoing training can inflate your overall costs. By opting for outsourced accounting services, you can not only save on these expenses but gain access to specialized expertise, potentially leading to better financial management practices. Indeed, you could Reduce Overhead Costs with Outsourced Accounting … that you might not achieve with a full-time staff. Along with the basic salary, you should consider the full range of employee benefits that come with in-house staff. These can include health insurance, retirement contributions, paid time off, and bonuses, all of which significantly add to the cost of hiring an accountant or a bookkeeping team. By outsourcing, you can eliminate these expenses entirely, allowing you to allocate your budget more efficiently while still receiving top-notch accounting services tailored to your needs. Operational costs can often remain hidden until you do a thorough audit of your financial structure. These include the expenses tied to maintaining a workspace for your accounting staff, the cost of accounting software subscriptions, and the potential productivity loss while your team gets up to speed on new technologies or regulations. In addition, the potential inefficiencies involved with keeping your accounting in-house can escalate your operational costs dramatically. For example, if your staff members need to spend time on training sessions to keep up with changing legislation, this not only translates to lost productivity but also takes them away from other critical tasks. By leveraging outsourced services that offer comprehensive support, you can streamline your operations and ensure you’re not expanding your budget unnecessarily. This allows you to focus on growing your business rather than drowning in administrative tasks. Not only does outsourcing accounting and bookkeeping create potential avenues for cost savings, but it also offers advantages that can significantly enhance your business operations. Engaging with specialized firms allows you to benefit from expert knowledge and advanced tools that might be too expensive or complicated to implement in-house. This can lead to improved accuracy, greater efficiency, and a deeper understanding of your financial landscape. With outsourcing, you gain access to advanced technology that may otherwise be out of reach for your organization. Many accounting firms invest in sophisticated software and systems designed to streamline processes and provide real-time insights. This not only saves your time but enhances the accuracy of your financial reporting. With outsourcing, you can tailor your accounting and bookkeeping services to match the growth and changing needs of your business. This scalability and flexibility enables you to adjust your services based on seasonal demands or rapid growth without the hassle of hiring additional staff or training current employees. Understanding the importance of scalability and flexibility can significantly impact your financial management strategy. This approach allows you to quickly scale operations up or down, depending on your current needs. You gain the advantage of leveraging professional services during peak times while avoiding the overhead costs associated with permanent staff during slower periods. This not only helps optimize your financial resources but also contributes to a more strategic and thoughtful management of your overall business processes. Unlike many business strategies that promise seamless execution, outsourcing accounting and bookkeeping operations comes with its own set of challenges. While it can lead to significant cost savings, the transition may also expose your business to a range of risks, particularly if not managed properly. You must conduct thorough assessments of potential partners to ensure reliable service delivery. You can explore more about this topic in the article on Outsourcing For Cost Reduction & Risk Management. These challenges can encompass everything from loss of direct oversight to issues with the quality of service, which can have downstream effects on your financial health. After outsourcing your accounting and bookkeeping operations, one of the primary challenges revolves around data security. Entrusting a third party with your sensitive financial information increases the potential for breaches, unauthorized access, or other vulnerabilities. You must ensure that the outsourcing provider maintains stringent security protocols to protect your data from cyber threats and breaches. Failure to do so could not only jeopardize your financial standing but also harm your reputation in the eyes of your clients. The success of your outsourced services largely depends on effective communication and control mechanisms. You may find that working with an external team can lead to misunderstandings or misalignment on project objectives, impacting the quality of work. Regular updates and reviews are important, yet they can be challenging to establish if you do not have a solid framework in place. This lack of direct oversight could mean that issues may go unnoticed until they escalate. Also, it is vital to establish a clear line of communication and set expectations upfront. Without consistent communication, you may face delays, errors, or even revisions that can incur additional costs. Keeping in close contact with your outsourcing provider ensures that you can promptly address any issues that may arise and maintain a desired level of control over your operations. Your approach to implementing an outsourcing strategy for accounting and bookkeeping is vital to your success. A well-defined strategy will not only help in understanding the logistics involved but also in easing the transition for your team and ensuring that your organization continues to thrive. It begins with thorough planning that takes into consideration both the operational and emotional aspects of such a change. Beside logistical considerations, you must also focus on how the transition will unfold within your team. This involves selecting a reliable outsourcing partner that aligns with your organization’s values and can meet your specific requirements. You need to draft a clear timeline showcasing the different phases of outsourcing, from initial engagement through to full integration. During this period, consistent communication is key to alleviate any concerns that staff members may have about their roles. One of the most significant challenges you may face during this transition is managing your current staff. It is important to address any potential fears and anxieties that could arise from the outsourcing arrangement. You should foster an environment of transparency by keeping communication lines open and encouraging feedback from your team. Assign dedicated personnel to oversee this transition, ensuring that employees feel supported and valued during the process. The emotional landscape when outsourcing can be complex, as some team members might fear possible job loss. To mitigate these concerns, it is vital to clearly articulate the purpose behind the decision to outsource, emphasizing how it will create more strategic roles for current staff. Additionally, providing staff with training opportunities or upskilling workshops can ease apprehensions, positioning them as integral players in your organization’s journey. This approach can transform potential negativity into a sense of ownership and motivation among your staff during this significant transition. All businesses need to evaluate the effectiveness of their outsourcing decisions, particularly when it comes to accounting and bookkeeping. Successful measurement often comes down to Key Performance Indicators (KPIs). These metrics can provide you with concrete insights into the financial health of your company. Important KPIs may include the accuracy of financial reports, turnaround times for vital documents, and overall cost savings achieved through outsourcing. By regularly tracking these indicators, you can assess whether the changes you’ve made are benefiting your bottom line and how they contribute to the overall efficiency of your operations. Against various aspects of your accounting activities, KPIs serve as a benchmark to compare the performance of your in-house staff versus an outsourced partner. While it may be tempting to rely solely on financial outcomes, it’s vital to include qualitative measures as well. For example, assessing employee satisfaction with accounting services or the ability to focus on core business functions can also signal success. By having a well-rounded view of performance through comprehensive KPIs, you can determine the true value of your outsourcing initiative. With outsourcing comes the need for a thorough Return on Investment (ROI) analysis. This evaluation helps you ascertain how much value your business has gained in relation to the expenditures made for outsourced accounting and bookkeeping. Key considerations in this analysis include not just the direct cost savings from reduced staffing needs, but also indirect benefits such as increased productivity and access to expert knowledge that may have been previously unavailable within your organization. Also, understanding the ROI helps you make strategic decisions regarding your future investment in outsourcing. By comparing the costs involved with the gains achieved over a specific period, you can more accurately gauge whether outsourcing is an effective solution for your business. Ultimately, a positive ROI can indicate that you are on the right path, while a negative return may suggest a need for reassessment of your outsourcing arrangement or even the service provider you have chosen. On the whole, outsourcing your accounting and bookkeeping functions can be an effective strategy for reducing staff costs. By delegating these crucial tasks to external professionals, you can eliminate expenses associated with hiring, training, and retaining full-time employees. This not only streamlines your operations but also allows you to focus on your core business activities, ultimately leading to better efficiency and productivity. Moreover, many outsourcing firms offer scalable solutions that you can adjust as your business needs change, ensuring you only pay for the services you require. Additionally, outsourcing provides access to specialized skills and the latest technologies that may be cost-prohibitive in-house. You gain the advantage of professional expertise without the overhead associated with an internal team. This mixture of cost savings and access to advanced capabilities can significantly enhance your financial management and strategic decision-making. Therefore, if you’re looking to reduce staff costs while maintaining high-quality service in your accounting and bookkeeping practices, outsourcing can be an advantageous path to consider. A: Outsourcing accounting and bookkeeping can lead to significant staff cost reductions by eliminating the need for full-time in-house employees. Companies can avoid expenses related to salaries, benefits, and training that are typically associated with maintaining an internal accounting team. Additionally, outsourced services often operate on a pay-per-use model, allowing businesses to pay only for the services rendered, further streamlining their operational costs. This flexibility allows organizations to allocate resources more efficiently across different areas of the business. A: While outsourcing can lead to direct cost savings, businesses should be aware of potential hidden costs. These may include onboarding costs for integrating external services, technology expenses for software and system integration, and communication challenges that can arise when working with outsourced teams. It’s also important to factor in the time needed to manage the relationship with the outsourced provider and ensure that service quality meets expectations. Properly vetting the vendor and having clear agreements can help minimize these potential costs. A: Before making the decision to outsource, a business should consider several factors. First, evaluate the current internal workload to determine if outsourcing could alleviate pressure or improve efficiency. Second, assess the costs associated with both in-house operations versus outsourcing options, including potential savings. Third, investigate the qualifications and reputation of potential outsourcing partners to ensure they have the expertise and reliability required. Finally, consider the nature of the business and whether external handling of sensitive financial information aligns with your company’s comfort level and security protocols.

Cost Analysis of In-House vs. Outsourced Accounting

Direct Salary and Benefit Expenses

Hidden Operational Costs

Benefits Beyond Cost Reduction

Access to Advanced Technology

Advantages of Advanced Technology

Real-time reporting

Enables timely decision-making

Enhanced security

Protects sensitive financial data

Automated processes

Increases efficiency and reduces manual errors

Data analytics

Provides insights for strategic planning

Scalability and Flexibility

Potential Risks and Challenges

Data Security Concerns

Communication and Control Issues

Implementation Strategy

Transition Planning

Staff Management During Outsourcing

Measuring Success

Key Performance Indicators

Return on Investment Analysis

Final Words

Q: How can outsourcing accounting and bookkeeping help in reducing staff costs?

Q: Are there any hidden costs associated with outsourcing accounting and bookkeeping services?

Q: What factors should a business consider before deciding to outsource accounting and bookkeeping?